When it comes to guiding a deal smoothly from “offer accepted” to “keys in hand,” nothing beats having a rock-solid checklist. As someone who’s spent countless hours side-by-side with transaction coordinators, I’ve seen firsthand how a simple slip—one forgotten form or missed deadline—can turn a dream closing into a scrambling scramble.

Below are the five must-have tasks every Transaction Coordinator (TC) needs on their go-to checklist. Follow these, and you’ll spend less time firefighting and more time closing deals (and smiling).

1. Seamless Client Kickoff & Paperwork Round-Up

Why it matters: First impressions stick. Get the basics (names, contacts, property details) and those crucial signed disclosures up front, and you’ll avoid a month of awkward follow-ups.

What to do:

- Welcome packet: Send a friendly email that lays out what you need, why it matters, and how you’re going to make their life easier.

- Dynamic checklist: Tailor your list based on the deal type—residential, commercial, lease—so each client sees only the forms they actually need.

- Progress tracker: Keep a simple “Received / Pending” log. A quick glance should tell you exactly what’s in hand and what’s still dangling.

Pro tip: Offer a one-click upload (or even better, a shared folder link) so clients can drop docs without wrestling with their inbox attachments. Less friction = happier clients.

2. Deadline-Driven Timeline & Reminders

Why it matters: Inspections, appraisals, loan contingencies, closing disclosures—every milestone has a countdown. Miss one, and the entire deal can stall or worse.

What to do:

- Master timeline template: Sketch out your default path—Day 0 = contract signed, Day 3 = earnest money due, Day 10 = inspection window closes, Day 30 = closing, etc.

- Automated alerts: Rather than manually scanning calendars, set up reminder bullets (e.g. “3 days before inspection,” “5 days before closing”) that trigger a quick ping to you and your client.

- Visual “risk ribbon”: Keep a color-coded bar or simple chart front-and-center so you can see “green” (far out), “yellow” (coming up), or “red” (urgent) at a glance.

Pro tip: When a date shifts—say, the appraisal gets pushed back—update your template once and let all the dependent deadlines adjust automatically. No extra clicks, no guesswork.

3. Centralized Communication Hub

Why it matters: Between emails, texts, phone calls, and app notifications, messages can scatter across platforms. Consolidate everything in one spot so nothing slips between the cracks.

What to do:

- Single feed per deal: Whether it’s the buyer’s lender or the seller’s agent, everyone’s messages funnel into one conversation thread tied to that file.

- Role-tags & filters: Mark notes with labels like

#agent,#buyer,#lenderso team members only see what’s relevant to them. - Automated check-ins: Whenever you hit a milestone—a completed inspection, a funding approval—fire off a quick status update to all parties so they’re always in the loop.

Pro tip: Keep a running audit trail: timestamps, who said what, when. If anyone ever questions an instruction or a promise, you’ve got the full history at your fingertips.

4. Compliance & Audit-Ready Records

Why it matters: Real estate is one of those “dot every i, cross every t” industries. Regulatory slip-ups cost time, money, and sometimes licensure.

What to do:

- Immutable logs: Every action—file uploaded, status changed, note added—gets a date-and-time stamp. Think of it like a public diary: you can never erase or overwrite records.

- Versioned docs: If someone replaces or updates a form, keep the old copy around. That way you can always roll back or reference exactly what was submitted when.

- Weekly compliance check: Run a quick “missing disclosure” or “overdue milestone” report so you can spot gaps before they become emergencies.

Pro tip: Turn those compliance snapshots into your Key Metrics—track how often you hit (or miss) your own SLAs so you know exactly where to tighten up.

5. Smooth Closing Coordination & Wrap-Up

Why it matters: Closing day is your victory lap—but only if every T, signature, and notarized form is in the right place. One last hiccup can delay funding or even derail the whole thing.

What to do:

- Final doc package: Gather contracts, disclosures, closing statements, wiring instructions—all in one neat folder. Bonus points if you can share a single PDF instead of six attachments.

- 48-hour reminder: Send a “Ready for closing” email that reconfirms time, place, and any last-minute to-dos (IDs, cashier’s checks, etc.).

- Post-closing survey: Ask “How did we do?” right after signing. A quick one-click rating plus a “What could have been smoother?” free-text box gives you gold-mine feedback.

Pro tip: Build a “clone deal” feature so when your next transaction comes in, you can copy over all the same templates, checklists, and reminders—no reinventing the wheel.

Wrapping Up

A repeatable, living checklist is your secret sauce as a Transaction Coordinator. Nail these five areas and you’ll transform chaos into calm:

- Onboarding & Docs

- Timeline & Deadlines

- Unified Communication

- Compliance Trail

- Closing & Feedback

Keep your process flexible—dates shift, forms change, deals evolve. But with these essentials etched into your playbook, you’ll handle every curveball like a pro, delight your clients, and free up brainspace to focus on growth (or maybe just breathe easier).

Ready to level up? Grab a blank sheet, draft your own master checklist around these five pillars, and start closing with confidence. You’ve got this.

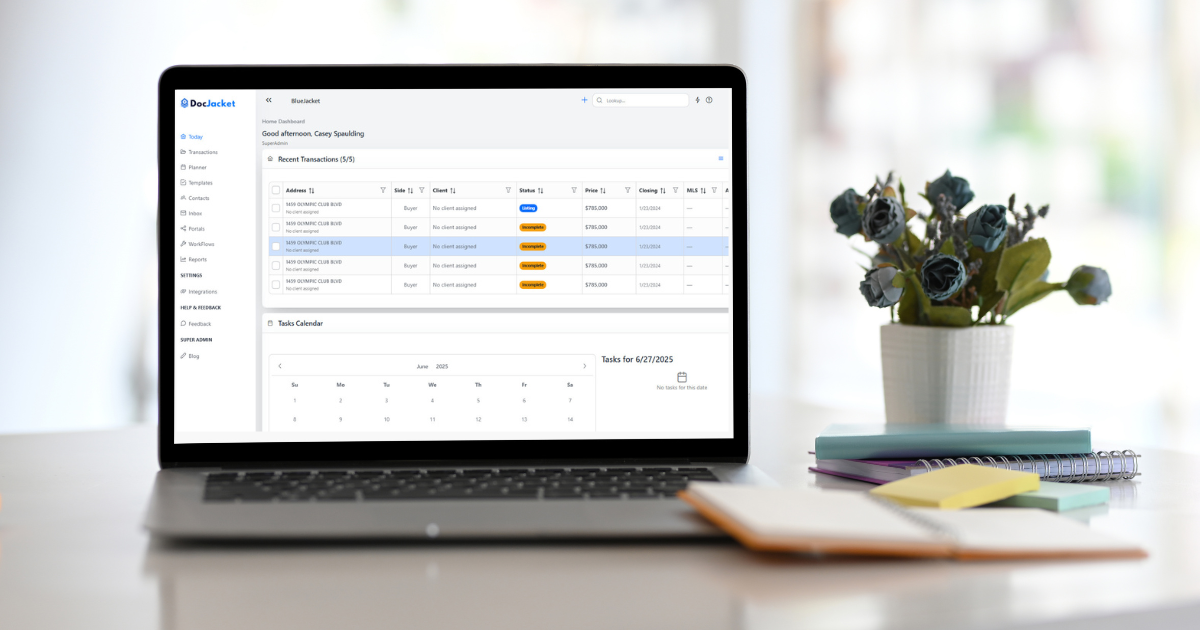

Ready to streamline your deals?

📥 Download your free “TC Quick-Start Checklist” (PDF)